Clean books.

Clear decisions.

Accounting & finance operations for growing businesses that need fast, trustworthy numbers to run the business with confidence.

We are the winner of Advisory Innovator of the Year

Clean Close. Real Ownership.

We run accounting and finance ops like an internal department: a predictable month-end close, reconciled books you can trust, and clear explanations of what changed and what to do next.

You get responsive support during crunch time, tighter controls as you scale, and a system that works across your stack so decisions get faster, not riskier.

Outcomes

What changes when finance is done right

Close faster

A consistent close cadence so you’re not making decisions on stale or inaccurate data.

Trust the numbers

Reconciled accounts and fewer surprises so decisions don’t come with second-guessing.

Know your runway

Clear cash visibility and forecasting support so you can plan hires and spend with confidence.

Reduce chaos

Simplified tools and workflows so finance supports momentum instead of slowing teams down.

How We Deliver Clarity

Speed & responsiveness

Fast answers, proactive communication and fewer bottlenecks.

Ownership

One team that owns the outcome end-to-end. No black boxes. No hand-offs.

Practical problem solving

We fix root causes across finance ops and systems, not just surface-level accounting issues.

Modern finance operations

Automation where it adds value, controls that scale, and systems that grow with the business.

How We Work

We run a consistent month-end cadence, keep your numbers decision-grade, and remove the back-and-forth with smart finance workflows, so you spend less time chasing receipts and more time running the business.

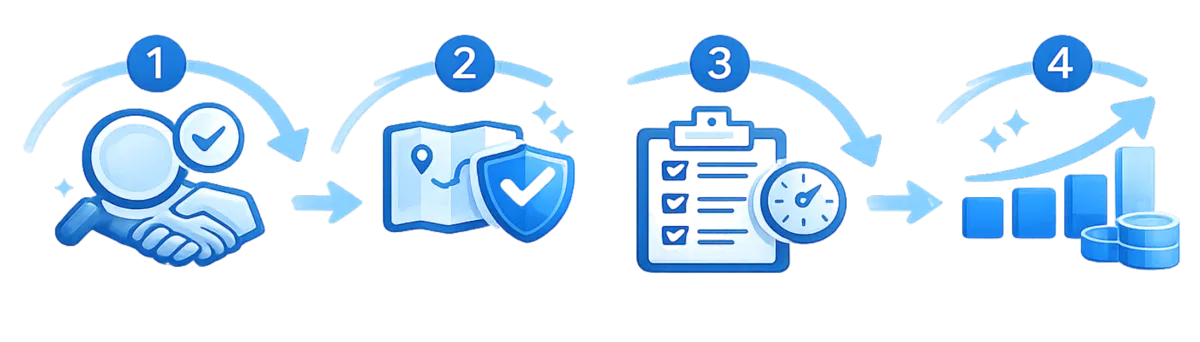

Fit Check

Quickly confirm fit and identify what you actually need.

Discovery

Map your complexity, risks, and priorities.

Ongoing cadence

Consistent close and continuous improvement.

Reporting

Monthly financials, clear notes and a consistent cadence.

What our Customer are Saying

Frequently Asked Questions

What’s the difference between Core, Growth, and Strategic Partner?

1. Core - Your day-to-day accounting department, managed with Controller-level oversight.

2. Growth - Controller-owned month-end close discipline + controls + system hygiene so numbers are decision-grade.

3. Strategic Partner - Runway/forecasting + board-ready reporting and decision support grounded in clean, reliable data.

What services do you offer?

Depending on scope and package, we can support:

- Monthly bookkeeping + month-end close

- Payroll coordination and reconciliations

- Sales tax filings and remittances

- AP / bill pay workflows and approvals

- AR workflows (invoicing and collections rhythm)

- Systems and workflow cleanup (automation, tools, process design)

- Forecasting, runway, and KPI reporting

- Board/investor reporting support

Do you handle “outsourced bookkeeping” or act as an accounting department?

We operate like an accounting department: clear ownership, predictable monthly cadence, and modern tooling—built to produce decision-ready numbers, not just compliance output.

What’s included in monthly bookkeeping?

Typically:

- Bank/credit card reconciliations

- Categorization rules and bookkeeping maintenance

- Monthly financial statements (P&L + Balance Sheet)

- Close checklist execution and review (depth varies by package)

Advanced work (forecasting, multi-entity, complex revenue recognition, large cleanups) is scoped separately or delivered under the appropriate package.

Clean books. Without the chaos.

If you’re behind on books or need a cleanup sprint, we’ll route you to the fastest next step.

Follow us on Socials: