Accounting Cleanup & Catch-Up Services

When the Books Are Behind, or Just Not Right

We are the winner of Advisory Innovator of the Year

Cleanup & Catch-Up Bookkeeping

Messy books don’t just slow reporting. They delay decisions, distort cash flow, and create risk at exactly the wrong time.

Vizhen’s Cleanup & Catch-Up service is designed for growing businesses that need their financials fixed properly, once, and set up for scale, not patched together.

Who Is This For

Behind on:

Bookkeeping by several months or years

Preparing for:

Due diligence

Financing or acquisition

Tax filings or CRA / IRS review

Migrating from:

A previous bookkeeper

DIY accounting

Inconsistent internal processes

Experiencing numbers that:

Don’t match the bank

Change every month

Can’t be trusted for decisions

If your instinct is “we just need to clean this up before we move forward” - you are in the right place.

What “Cleanup” Actually Means at Vizhen

This is not data entry or a quick reconciliation.

Our cleanup work is controller-led, structured, and outcome-driven.

Bank and credit card reconciliations

General ledger corrections and reclassification

Revenue recognition issues

Expense categorization and COGS alignment

Payroll and remittance discrepancies

Sales tax gaps - HST / GST / VAT / sales tax

Balance sheet integrity - AR, AP, loans, equity

Month-end close normalization

The objective is simple: financials you can rely on, without footnotes or caveats.

How It Works

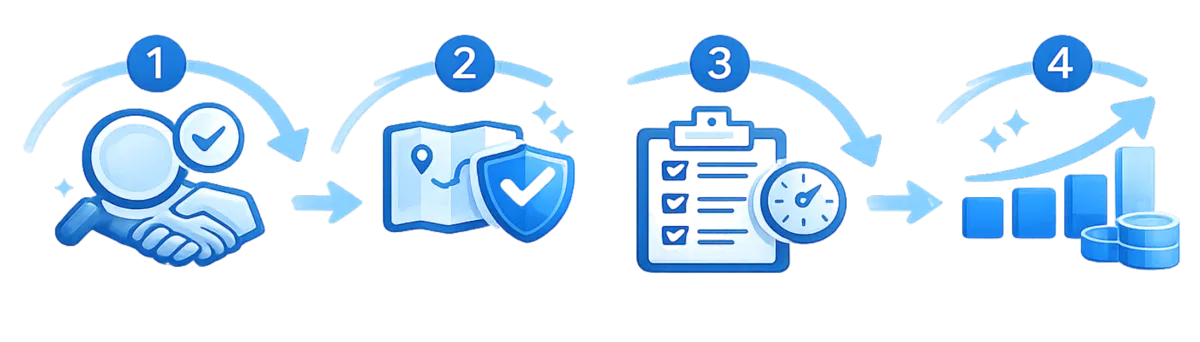

How Our Cleanup Process Works

Diagnostic Review

We assess:

Data quality

Scope of issues

Periods affected

Risk and urgency areas

Structured Cleanup Execution

Our Team:

Works period by period

Documents all adjustments

Resolves root causes

Aligns books to accounting best practices

Validation & Close

Before completion, we:

Reconcile all key balances

Review results at a controller level

Confirm readiness for taxes, lenders, or investors

Forward-looking Cleanup

We assess:

Standardize chart of accounts

Implement monthly close routines

Transition you into ongoing Core or Growth support

What You Get:

A clear plan, timeline, and fixed scope before work begins.

No silent changes. No black box.

You receive clean starting-point financials, not just “updated” ones.

What Makes Vizhen Different

Most cleanup work fails because it is:

Done too cheaply

Delegated too low

Rushed without understanding the business

Vizhen approaches cleanup as a foundation-setting exercise, not a commodity service.

Controller oversight from day one

Clear scope and accountability

Designed to support growth, not just compliance

Seamless transition into ongoing support

Typical Outcomes

What changes when finance is done right

Accurate, reconciled historical financials

Confidence in their numbers

Reduced tax and compliance risk

A clean baseline for forecasting and decision-making

Relief

Pricing & Timing

Cleanup work is scoped and priced after review, because every situation is different.

Typical engagements:

Range from a few weeks to a few months

Are quoted as fixed-fee projects

Can be phased if needed

We will never start cleanup without aligning expectations.

What Happens After Cleanup

Most clients choose to continue with:

Core – for ongoing monthly accuracy and compliance

Growth – for controller-level insight and cash-flow clarity

Strategic Partner – when decisions, scale, or complexity increase

Cleanup is the reset. What you build on top of it is where the real value begins.

What our Customer are Saying

Frequently Asked Questions

How do I know if I need a cleanup (vs regular monthly bookkeeping)?

If you’re 2+ months behind, dealing with unreconciled/backlogged books, or you’ve been running things in Excel, cleanup is the right starting point. It’s designed for “behind, messy, or unclear” situations where you first need a structured review and plan.

How long does a cleanup actually take?

If you need execution (not just a plan), the Cleanup Sprint is typically:

- Core Fixes: ~2–3 weeks

- Expanded: ~3–4 weeks

- Advanced + Integrations: ~4–6 weeks

Your wireframe also positions cleanup as a 2–4 week sprint depending on what’s broken and how quickly inputs come in.

What do you need from us to start (so this doesn’t drag on)?

Cleanup moves fastest when you can provide:

- Access to your accounting system (or current files if you’re in Excel)

- Bank/credit statements and key integrations

- Payroll context (if applicable)

Any deadlines (year-end/tax/financing) so the sprint is prioritized correctly.

Does cleanup include tech/integrations help (Stripe, payroll, expense tools, etc.)?

Sometimes, based on tier:

- No Tech Advisory in Essential

- Optional Tech Advisory add-on in Standard

- Included Tech Advisory in Premium tiers

So if the mess is caused by broken workflows/integrations, we’ll either include it (Premium) or offer it as an add-on (Standard).

What happens after cleanup? Do we stay on monthly support?

Often, yes. Cleanup is meant to get you back to “stable and trustworthy,” and then you can roll into ongoing monthly support once the foundation is fixed. Your wireframe explicitly calls out an option to continue monthly after the cleanup sprint.

Ready to Get the Books Back Under Control?

If you’re tired of guessing or explaining why numbers don’t tie, let’s start with a cleanup assessment.

We’ll tell you:

What’s wrong

What it takes to fix

Whether Vizhen is the right fit

No pressure. Just clarity.

Follow us on Socials: